Simply half of highway funding is paid for by highway customers by funding mechanisms like gasoline taxes or automobile registration charges, and the most important share of that (the federal gasoline tax) has not been raised in over 30 years. Nevertheless, some in Congress have tried guilty the rise of electrical automobiles and fuel-efficient gasoline-powered automobiles for the federal authorities’s struggles to fund many years of road-building.

Beneath I stroll by why the federal authorities’s means to pay for highways has nothing to do with electrical automobiles and all the pieces to do with Congress’s insatiable want for road-building.

Quite a bit has modified since Congress final adjusted transportation funding

The Freeway Belief Fund is accountable for practically the entire federal authorities’s spending on transportation, with income sourced predominantly from gasoline and excise taxes and, more and more, injections of capital from the Basic Treasury. Aside from these intermittent transfers, Congress has not meaningfully modified the income for the Freeway Belief Fund for the reason that final improve in gasoline taxes, which went into impact on October 1, 1993.

How way back was that? Effectively, simply ¼ of U.S. adults had entry to a pc, and simply 2 % of the nation used the Web in 1993. And neglect “sensible telephones”—the primary mobile phone able to textual content messaging debuted in 1993, together with the primary battery-operated mobile phone.

Fittingly, The X-Information debuted simply two weeks earlier than the final change in federal gasoline taxes went into impact—this iconic TV present handled authorities forms and the unexplainable, matters which each sadly resonate in attempting to know the federal government’s strategy to the transportation system.

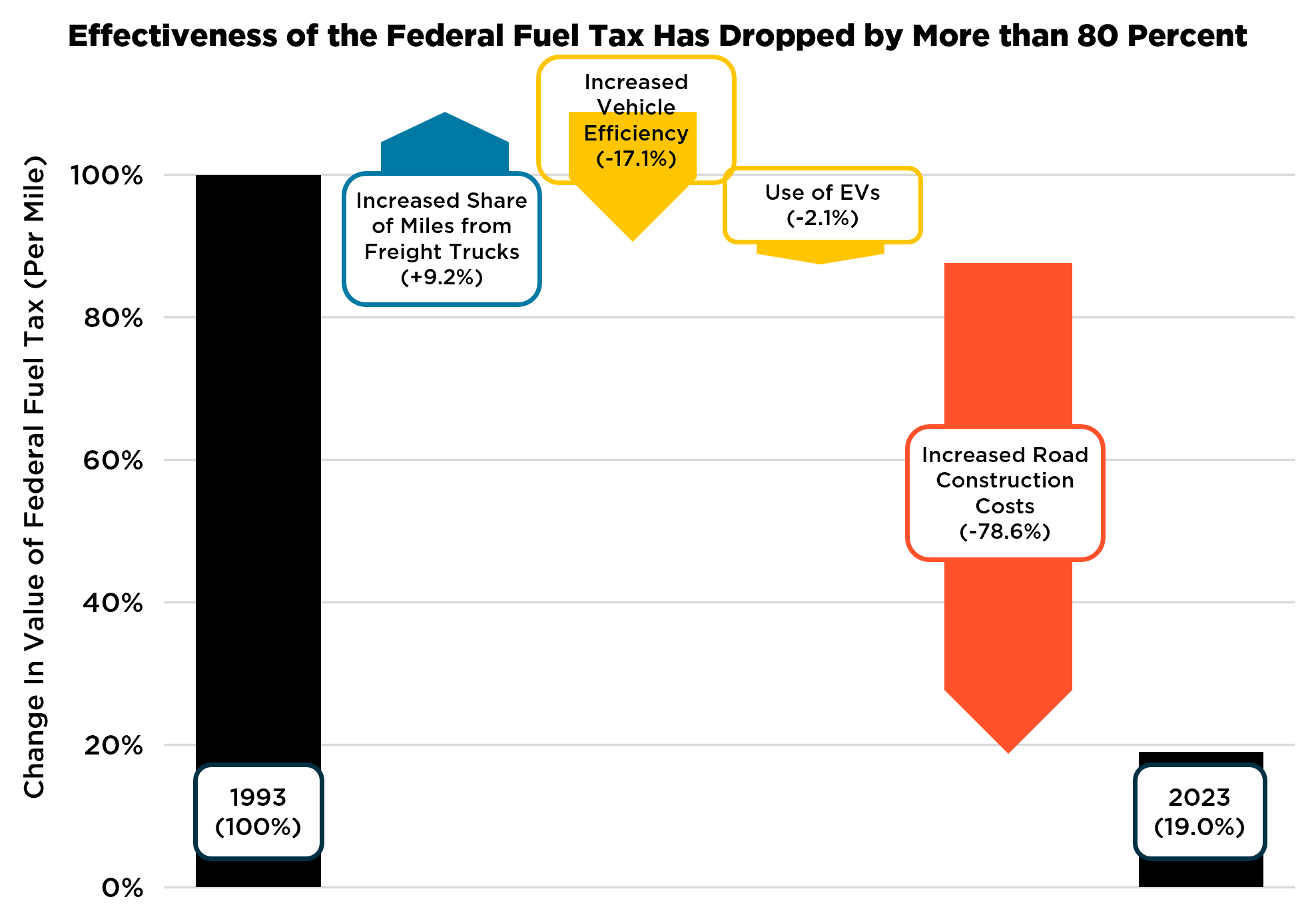

As one can think about, the passage of time has had a big influence on the worth of the federal gasoline tax. The present tax fee on a gallon of gasoline is simply 18.4 cents—and that 18.4 cents doesn’t imply the identical right this moment that it did when the tax went into impact in 1993. Inflation, the final measure of the price of shopper items, has greater than doubled since then, which implies that the worth of the tax to the households paying it’s lower than half what it as soon as was. It additionally hasn’t saved tempo with the price of gasoline, which has elevated by practically an element of three—thus, the federal authorities’s share of the price of a gallon of gasoline is about 1/3 what it was. And with regards to what you should purchase for that share, prices of highway building have far outpaced common inflation—that income buys right this moment lower than 1/4 of what it used to again in 1993.

Factoring in each the quantity of tax generated and what that tax is financing, the effectiveness of the federal gasoline tax has dropped by greater than 80 % because it was final modified in 1993. And the primary cause for that’s our ever-more-expensive freeway system.

Roads are costly, and freeway growth much more so

Building prices have skyrocketed for plenty of causes, however two stick out: a discount in competitors ensuing from consolidation within the building trade and a discount in capability on the state departments of transportation to facilitate aggressive bidding. Nevertheless it isn’t simply that building prices have exploded—it’s that the freeway system itself is a optimistic suggestions loop of prices begetting much more prices.

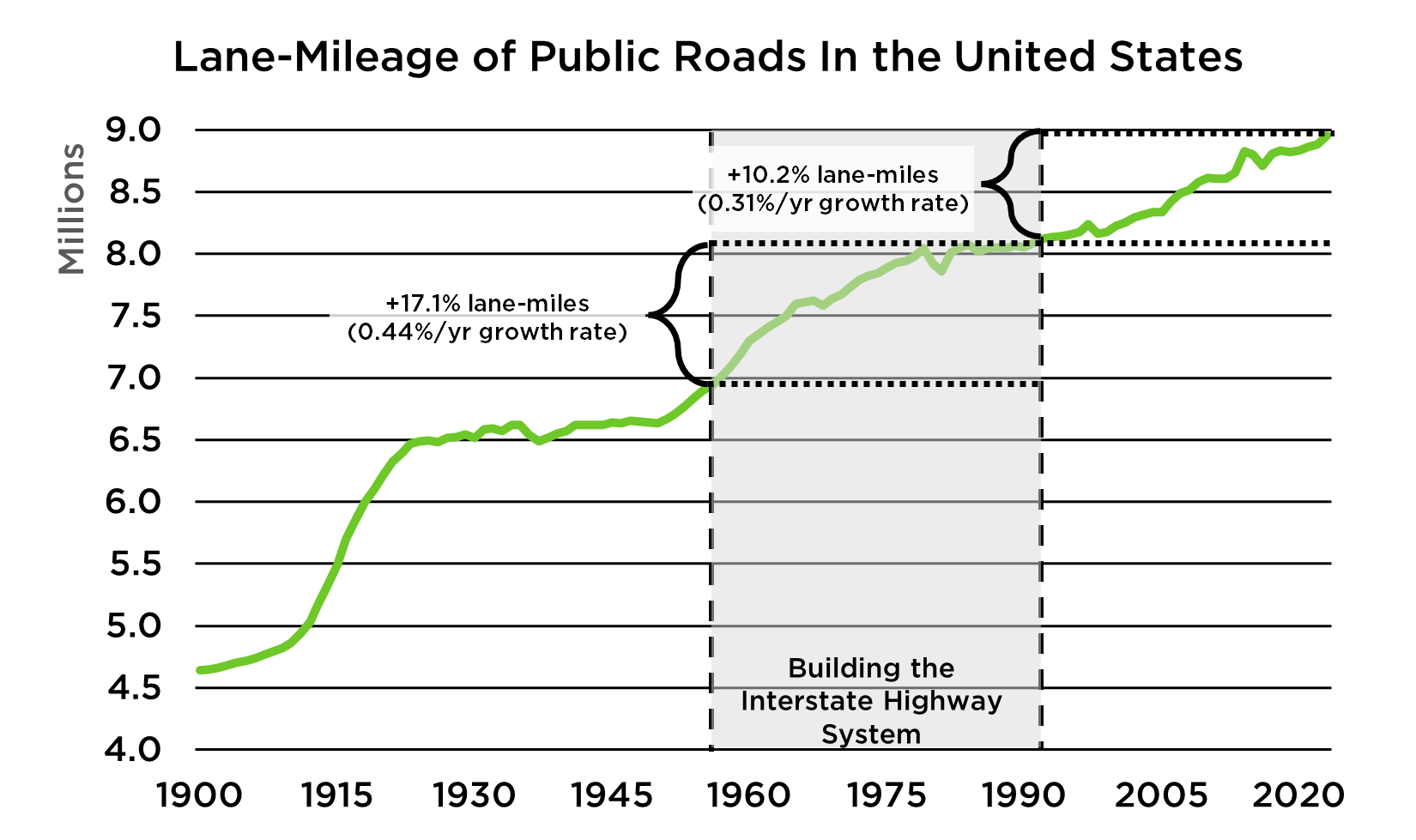

The unique interstate system conceived beneath the Federal-Assist Freeway Act of 1956 was accomplished in 1992, however slightly than cease then and there, freeway growth has marched onward. Public roads nationwide have elevated in lane-mileage by over 10 % for the reason that “completion” of the Interstate Freeway System. This fee of growth represents 70 % of what it was in the course of the building of the Interstate Freeway System—regardless of a theoretical completion of the system, we’ve barely curtailed growth.

Freeway growth just isn’t a one-time building price—new roads must repaired indefinitely, merely including to restore prices for infrastructure already constructed. Furthermore, increasing highways ends in a rise in utilization not simply of the brand new lanes of highway but in addition for the constructed system, too, by a phenomenon often known as induced demand, whereby you cut back boundaries to driving and, in flip, improve the quantity of driving that happens. Business vehicles, for instance, will improve site visitors on an interstate by between 19 and 29 % for each 10 % improve in capability, leading to a web adverse influence on site visitors circulation.

Because the nation has continued to construct out the freeway system, the infrastructure constructed creates an ever-increasing price spiral—even after adjusting for the elevated price of building, the quantity spent on restore has greater than doubled since 1993, thanks largely to a doubling of miles traveled by the most important and heaviest automobiles on the highway (industrial vehicles) and an general improve in journey by over 40 %. Maybe for this reason the nation has a backlog of over $1 trillion in upkeep.

It’s the unsustainable prices of our freeway system that’s bankrupting the Freeway Belief Fund, and this results in an ever-increasing share of common public funding to bail it out if nothing modifications. Highways are a pricey use of land, with one examine discovering that the prices of freeway growth outweigh the advantages by 3 to 1,even with out factoring in exterior social harms like well being impacts from added site visitors air pollution. It’s clear we must be rethinking the established order of unending highway growth.

Automobiles are extra environment friendly now…and that’s a superb factor!

As a result of the politics of coping with the precise downside of funding our freeway system is tough, there’s a want to discover a scapegoat. On this case, politicians have turned their consideration to how far more environment friendly our automobiles are.

Each passenger vehicles and vehicles and heavy-duty automobiles have gotten extra environment friendly over time. That implies that drivers can go farther on a gallon of gasoline or diesel. That is an unabashed good factor—bettering effectivity is a essential a part of decreasing world warming emissions, and it saves drivers cash, one thing that’s particularly necessary with costs for households on the rise. And when a rising share of these effectivity beneficial properties are about eliminating oil use and the volatility of gasoline costs totally from the equation for households due to electrification, enhancements in effectivity are an excellent factor.

Nevertheless, for the reason that funding for the Freeway Belief Fund is essentially primarily based on revenues from gasoline use, utilizing much less gasoline per mile implies that a part of the decreased prices of gasoline to shoppers include decreased contributions to the Freeway Belief Fund. However is that this truly an enormous deal? In contrast with different components, this can be a drop within the bucket.

Since 1993, the passenger vehicles and vehicles on the highway have improved their gasoline effectivity by nearly 19 %. Business automobiles have improved by 18 %. The disproportionate improve in journey by diesel-powered vehicles implies that the loss in income per mile traveled is barely simply over 11 % on account of effectivity enhancements. In contrast with an erosion of shopping for energy for the HTF of over 78 % as the results of skyrocketing building prices since 1993, and even simply the erosion of worth of 54 % associated to common inflation, it’s clear that the story of HTF insolvency just isn’t associated to effectivity.

Electrical automobiles are a small share of potential income

Though EV drivers, like all of us, already pay for roads by common tax income, some nonetheless declare that it’s unfair that EV drivers don’t pay a gasoline tax. However this each ignores the best way roads are funded and the taxes that EV drivers already pay for electrical energy utilization.

The notion that EV drivers are getting a free journey is simply plain incorrect, thanks partially to taxes and costs levied on the state and native stage, the place greater than 80 % of highway funding comes from. In 36 states, there may be even already a web tax penalty for driving an EV in comparison with a gasoline automobile due to the mix of taxes and costs already in place. However even on the federal stage, the dearth of a federal charge on EV drivers is a negligible contribution to any shortfall within the Freeway Belief Fund.

In the present day, we estimate that EVs are accountable for simply over 2 % of miles traveled within the U.S. Final 12 months alone, freeway building prices elevated by 6 %. At the same time as EVs grow to be a rising share of the automobile fleet, we estimate that they are going to make up simply 3 to eight % of highway journey between now and 2030, relying on the diploma of to which the present administration succeeds in eliminating EV incentives and protecting automobile laws.

At simply 3 to eight % of mileage traveled, charging EV drivers a mileage charge corresponding to that of gasoline-powered automobiles would have little influence on the solvency of the Freeway Belief Fund, which spends about 60 % greater than it takes in. Nevertheless, it might act to dissuade EV consumers, significantly if accompanied by the elimination of insurance policies designed to develop a nonetheless nascent market. Given the well being and local weather advantages of switching to electrical automobiles, we must be centered on enabling that transition, not thwarting it with pointless charges.

Congressional EV charges are each counterproductive and unfair

It’s unhealthy sufficient that the freeway foyer is pitching Congress that EV charges are a significant approach of addressing transportation income (as famous above, they’re too small to make a dent). It’s worse nonetheless when that strategy not solely runs instantly counter to our must transfer away from a petroleum-focused transportation however is punitively designed to overburden those that are making the selection to get off gasoline.

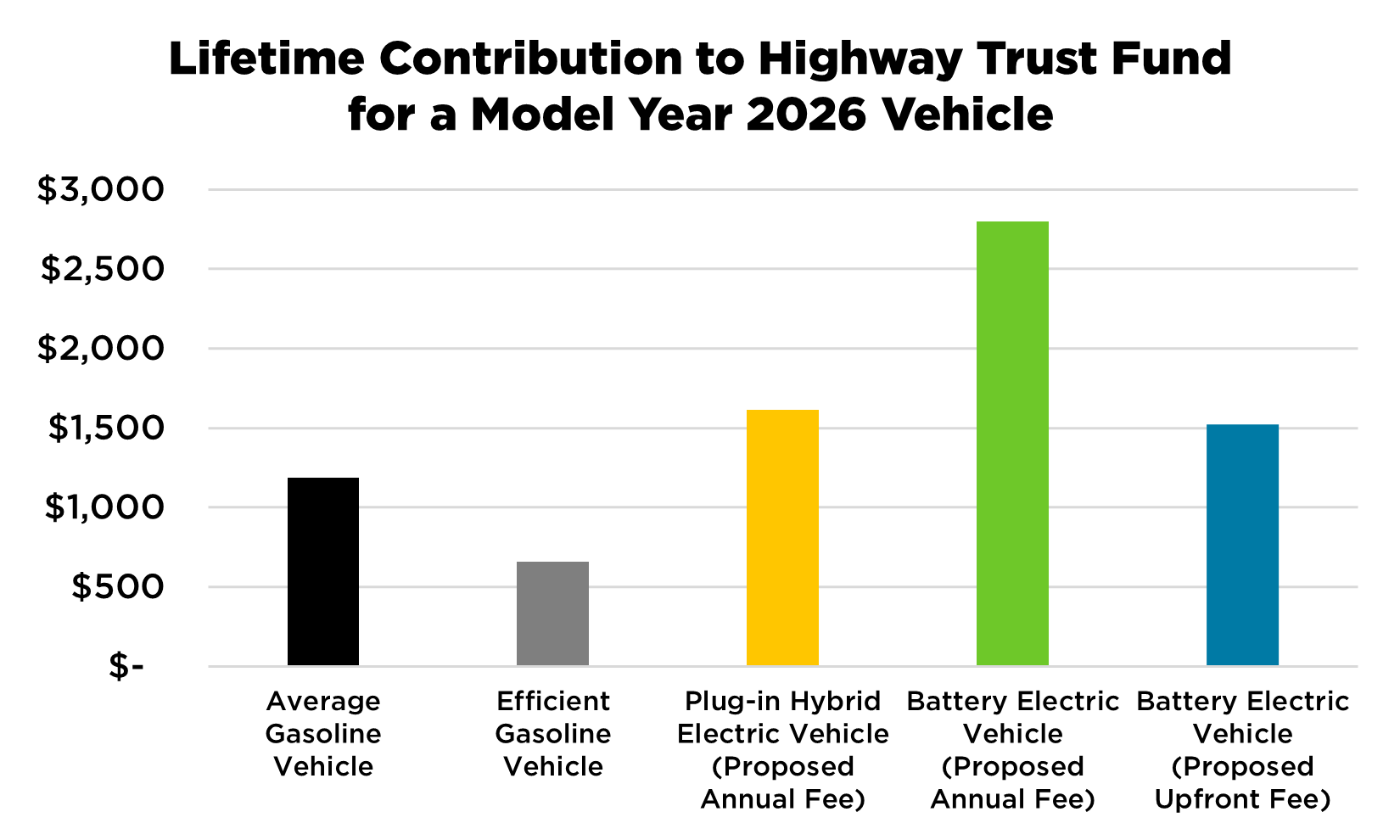

One proposal from Congress from U.S. Consultant Dusty Johnson (R-SD) and Sen. Deb Fischer (R-NE) is designed to disincentivize EV possession by forcing an upfront surcharge on EVs. New gasoline automotive consumers pay gasoline taxes after they gasoline, steadily over the lifetime of the automobile. If a automobile is bought, the subsequent proprietor can pay for the continued gasoline consumed, together with any related gasoline taxes. The Johnson and Fischer payments, nevertheless, impose two charges upfront on EVs, focusing on potential EV homeowners—the primary is a flat $1000 charge, regardless of any traits of the battery-electric automobile relating to weight or effectivity. The second is a further charge of $550 on the producer (which will likely be handed on to the automobile purchaser) for each battery module weighing greater than 1000 kilos—whereas based on the invoice authors this provision is focused at heavy-duty electrical vehicles, the anomaly in language might ensnare the over 90 % of light-duty EV packs that meet that weight threshold as effectively.

An upfront surcharge on an electrical automobile, significantly one which doesn’t exist on a gasoline automobile, would disproportionately burden EV drivers with the prices of roads in comparison with different drivers. Beneath present coverage, about 8 % of auto miles from now by 2030 can be pushed on electrical energy—with the proposed charges, and assuming Congress doesn’t let the present gasoline taxes expire in 2028 as they’re set to do, EV drivers would pay about 20 % of all federal taxes collected from passenger vehicles and vehicles in that very same timeframe, hardly a “justifiable share.”

One other just lately reported proposal would put an annual charge of $200 for battery-electric automobiles and $100 for plug-in hybrid electrical automobiles, but it surely’s once more designed to drive EV drivers to pay a considerably larger share than gasoline drivers. If Congress goes to enact a charge on EVs, it must be appropriate with how we assess charges on the remainder of the fleet. The present gasoline tax acts as a market sign to drivers and rewards effectivity—punishing drivers for utilizing automobiles which might be thrice as power environment friendly as common whereas rewarding drivers utilizing automobiles lower than twice as environment friendly as common is an inequitable mess.

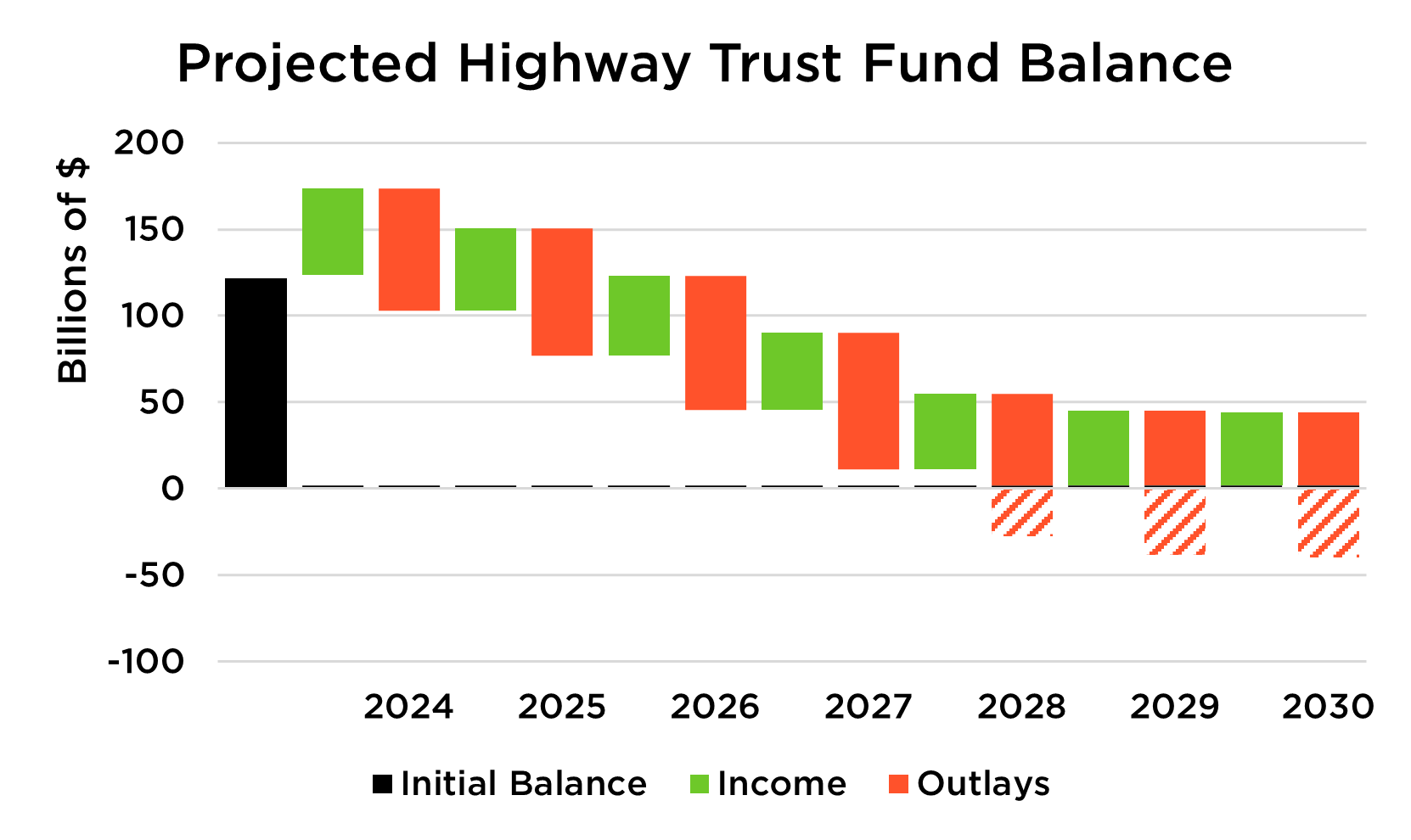

The freeway belief fund is damaged—EV charges aren’t going to repair that

The Congressional Price range Workplace confirmed of their newest evaluation of the Freeway Belief Fund that the Freeway Belief Fund is anticipated to spend $213 billion greater than it takes in ($261 billion) for fiscal years 2025 by 2030. We estimate even the unfair proposal put forth by Congress would increase between simply $7-33 billion over that very same timeframe, placing hardly a dent within the deficit even because it penalizes households for decreasing world warming emissions and public well being harms from their automobiles.

The largest downside with the Freeway Belief Fund isn’t what households are contributing—it’s the poor outcomes from that funding. Adjusted for inflation, the federal authorities could also be spending half what it used to on brand-new highways, however that also means tons of of miles of latest highways yearly, at a value of over $10 million per mile. On prime of that, main building tasks on current highways regularly end in elevated lane-miles—simply final 12 months we elevated lane-miles on over 10,000 miles price of roads, at a value of nearly $700,000 per mile.

The results of this growth is a freeway system that isn’t simply costly however unsustainable. The federal authorities has greater than doubled its spending on highway restore since 1993, even after adjusting for inflation, and but the federal share of spending on restore has truly gone down as a result of the Nationwide Freeway System is a big cash pit, emptying federal, state, and native coffers alike, with whole upkeep prices 3.5 instances larger in 2023 than in 1993, even after adjusting for inflation.

Funding extra roads received’t get us the place we have to go

Till our infrastructure displays a system that works for everybody, we shouldn’t be asking households to speculate extra of their hard-earned cash in it. Whereas prioritizing restore over growth by “repair it first” and even decreasing highway lanes through “highway diets” could also be smarter methods of investing in our roads, that’s hardly typical of the place our federal {dollars} go.

If Congress goes to guage the effectiveness of federal transportation funding, it should take a look at either side of the ledger, not simply the place the cash is coming from however the place it’s going. In any other case, the prices will proceed to balloon unsustainably, as we see with the Freeway Belief Fund.