(*Learn to the tip for an announcement about your private funds.)

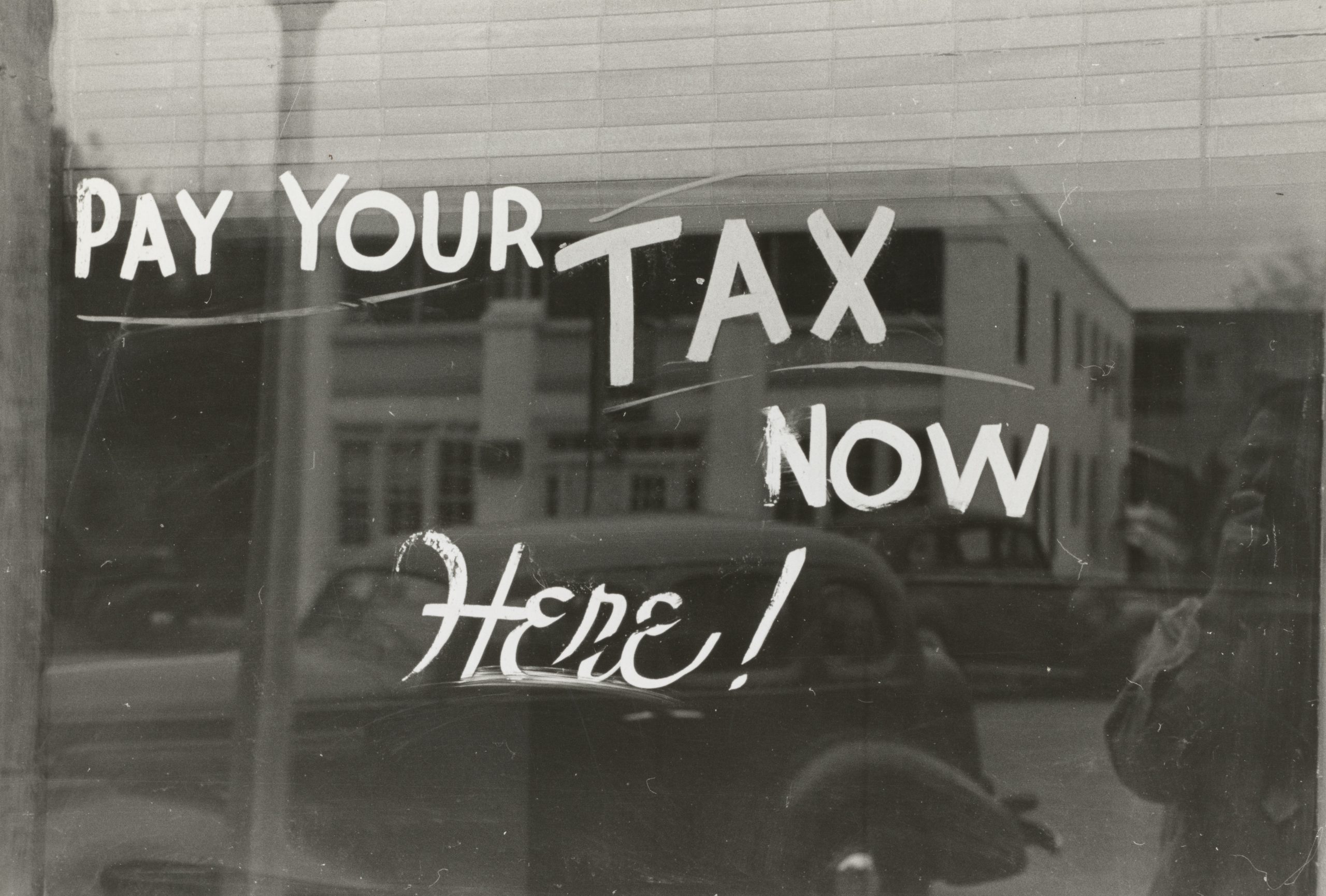

Tax day!

Simply listening to these phrases can set off stress, frustration, and that sinking feeling of loss. However what if I instructed you it doesn’t should be that approach? What if April fifteenth may really really feel like a win? A celebration of the way you’ve mastered your money circulation and monetary sport?

Why tax day hurts a lot

Most entrepreneurs dread taxes as a result of they really feel like one thing is being taken from them.

You’re employed exhausting, construct your enterprise, after which, increase! An enormous chunk of your cash disappears to taxes. It’s simple to see why this seems like a intestine punch.

People are wired to hate loss. We really feel the ache of shedding cash way over we really feel the enjoyment of gaining it. So, when April 15 rolls round and also you’re scrambling to determine the right way to pay your tax invoice, it’s no surprise it feels terrible.

The shift that adjustments every part

The important thing to creating tax day painless, and dare I say even gratifying, is to cease treating taxes as a loss. As an alternative, it is advisable reframe them as a deliberate expense that you simply’ve already accounted for. One of the simplest ways to do that? Arrange a tax account at your financial institution.

By routinely setting apart cash for taxes all year long, you remove the “taken from me” feeling. You don’t lose cash; you’ve already deliberate for it. It’s no completely different than budgeting for payroll, hire, or some other enterprise expense.

The straightforward resolution – open a tax account and remodel dread into {dollars}

- Open a separate checking account devoted solely to taxes. This must be separate out of your principal enterprise working account.

- Each time you obtain income, allocate a proportion to this tax account. (In Revenue First, I like to recommend setting apart 15% to 30%, relying in your revenue margins and tax bracket.)

- Do NOT contact this cash. It’s not yours to spend. It’s already earmarked for taxes.

- When tax day comes, you’re prepared. No scrambling, no stress, no last-minute panic. You simply minimize the test and transfer on together with your life.

The “Determine It Out Later” entice

Most enterprise house owners function underneath a harmful assumption: “I’ll determine it out in April.”

That’s the worst attainable method. It results in:

- Shock tax payments that drain your money reserves.

- Final-minute stress and monetary chaos.

- Danger of penalties and curiosity for those who can’t pay on time.

- A shortage mindset that retains you feeling such as you’re at all times behind.

If you proactively put aside cash for taxes, you remove all of those issues. You shift from reacting to taxes to proudly owning them.

Digging Deeper: Grasp Your Funds

If you wish to take full management of your monetary future, I extremely suggest testing these assets:

- Revenue First (Chapter 4, pages 77–92): Find out how the Tax Account setup will change your relationship with April 15 eternally.

- Repair This Subsequent (Chapter 4, pages 90–119): Construct monetary predictability past taxes.

- The Pumpkin Plan (Chapter 6, pages 95–110): Tie your income on to serving your greatest clients.

- Clockwork (Chapter 11, pages 200–226): Guarantee your enterprise runs easily—even throughout tax season—so you’ll be able to take a trip with out fear.

My remaining thought

As David Campbell, cofounder of Saks Fifth Avenue, mentioned:

“Self-discipline is remembering what you need.”

If you need monetary freedom, if you wish to remove stress, and if you wish to hold extra of your cash, then self-discipline in your money circulation is essential. Tax day doesn’t should be painful. With a easy shift in the way you handle your cash, it will probably change into your victory lap.

You’ve acquired this. And for those who haven’t arrange your tax account but, think about this your signal to make it occur right now.

As a result of entrepreneurs? We’re kinda superheroes. And superheroes don’t get knocked down by taxes.

-Mike

PS. Ever since I wrote Revenue First, I’ve been requested to jot down a e-book about private funds. This e-book has been an enormous objective of mine and it’s lastly coming to fruition.