Latest investments within the US battery and Electrical Car (EV) manufacturing {industry} are key to establishing a strong provide chain and supporting job development. Billions of {dollars} of investments have been pushed by a robust mixture of (1) ahead trying insurance policies like state and federal automobile requirements, (2) incentives designed to kickstart a home battery {industry}, (3) automaker recognition that the way forward for the auto {industry} is electrical, and (4) shopper demand for EVs.

Whereas the remainder of the world continues supporting their zero-emission commitments and races to be a part of the EV economic system, the Trump Administration and the 119th Congress are dismantling US {industry} help at practically each flip.

Two weeks in the past, Congress took the unprecedented step of revoking the authority of states to implement requirements accelerating the deployment of cleaner diesel vans and electrical passenger automobiles and heavy-duty vans—a proper that states have exercised for over 50 years to cut back automobile air pollution. Now, Congress and the Trump administration try to make use of the Finances Reconciliation Invoice to roll again EV manufacturing and shoppers incentives, undo federal passenger automobile gasoline economic system and emission requirements, and add an extreme $250 annual price on to EVs that’s two-to-three instances larger the taxes paid by the typical gasoline driver.

These actions aren’t solely a significant setback to the deployment of EVs in the USA, however a significant blow to the nation’s nascent EV battery manufacturing provide.

US provide chain investments and job development

Funding within the US EV provide chain is a great transfer for creating jobs, constructing know-how management in a rising {industry}, and decreasing prices. You don’t need to look too onerous to see that auto executives know EVs are the longer term. Even within the US, which lags behind different nations in EV adoption, 1 in 10 new automobile gross sales are electrical.

One crucial factor to success is constructing a strong EV provide chain right here within the US. There was a flurry of provide chain investments supported by the Biden Administration and the 117th Congress, following the passage of the Bipartisan Infrastructure Legislation (BIL) and the Inflation Discount Act (IRA).

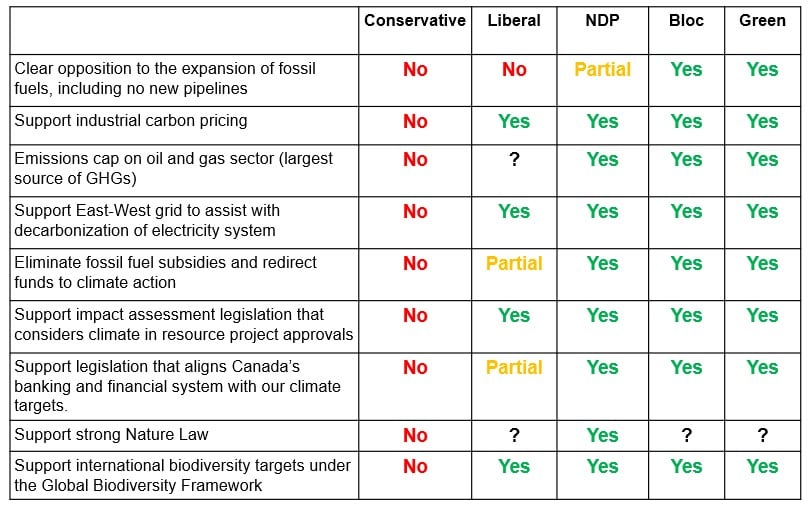

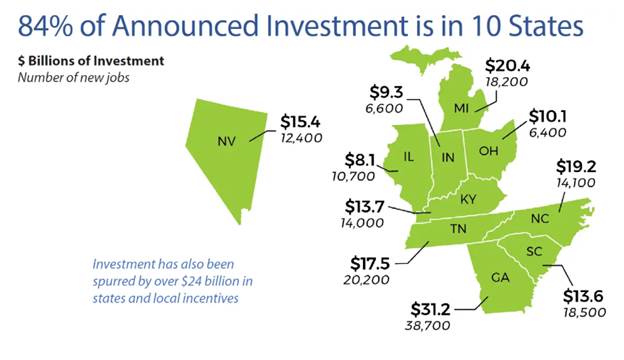

Over the previous decade, roughly $198 billion in introduced investments have been made within the manufacturing of batteries and electrical automobiles (EVs) within the US, with the potential to create round 195,000 new jobs. Over 80% of those investments have been introduced after the passing of the BIL in 2022, because of the grants, tax credit, and sponsored loans. These insurance policies are chargeable for spurring the creation of a extra dependable battery provide chain proper right here within the US. Notably, the states with the best investments embrace Georgia, Michigan, North Carolina, Tennessee, and Nevada.

Determine and calculations by EDF

Investments are being made all through the provision chain. If we have a look at lithium extraction, a mineral in all lithium-ion batteries, we see the US is forecasted to be a high lithium producer in 2030 attributable to elevated mining enlargement. The Argonne Nationwide Lab discovered that in 2022, Australia, Chile, and China have been high producers, however in 2030, the US, Argentina, and Australia will possible rise to the highest. Midstream battery manufacturing was a key goal of funding by the Biden Administration and the 117th Congress. This includes manufacturing battery inputs, comparable to cathodes, anodes, separators, electrolytes, and cells. The Argonne Nationwide Lab reported that as of 2024, there have been bulletins for 79 electrode and cell manufacturing services and 63 services for battery-grade parts manufacturing. Lastly, the US can also be quickly increasing the manufacturing of EVs and batteries. A 2024 research by EDF discovered that in 2028, EV manufacturing services can be able to producing 4.7 million new EVs every year, and by 2024, there have been bulletins that time to the yearly manufacturing capability of 1,083 gigawatt hours of EV batteries.

The roles related to these investments will even stimulate native economies. A current report by Atlas Public Coverage discovered that as of September 2024, 31% of the roles introduced have been in census tracts deemed as Justice40 deprived communities, which means they expertise excessive environmental and socio-economic burdens. As well as, they discovered that 12% are in communities which have skilled financial hardships because of the decline within the fossil gasoline {industry}. It was estimated that over 800,000 further jobs may very well be created by oblique employment – the results of elevated spending in communities.

However the Trump Administration and the 119th Congress try to slash many of those incentives that help this rising manufacturing base, together with the New Clear Car tax credit score (30D), the Various Gasoline Car Refueling Property Credit score (30C), and the Superior Manufacturing tax credit score (45X).

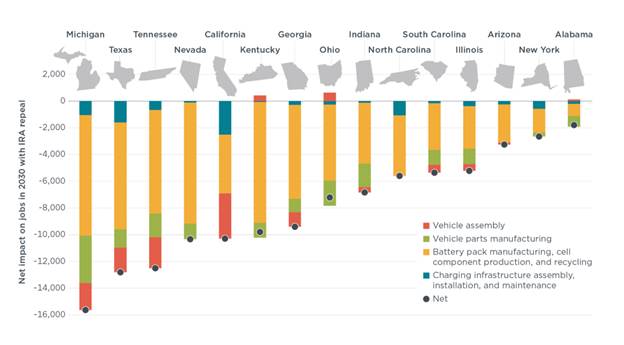

These coverage shifts are pulling the ground out from below the US-based battery and electrical automobile (EV) manufacturing {industry}, and we’re already seeing the cancellation of manufacturing facility plans. It’s clear that the reversal of those insurance policies, tax credit, and grants, will gradual the transition to EVs and is already hurting the US manufacturing base. An ICCT research estimates that repealing the IRA tax credit might lead to a lack of 130,000 direct and 310,000 oblique US jobs by 2030. Most of those jobs are positioned within the Midwest and southern states the place the manufacturing base is being established.

The online affect on jobs in 2030 if the IRA is repealed. Determine by ICCT.

We are able to nonetheless save the EV tax credit score

This large push in the direction of US EV manufacturing competitiveness was backed by sturdy demand-side insurance policies which might be in danger. The New Clear Car tax credit score (30D) included within the IRA reduces the price of EVs as much as $7,500, making them extra inexpensive for center revenue households. The tax credit score is tied to home mineral sourcing and battery manufacturing restrictions, thereby designed to incentivize automakers to deliver manufacturing to the US and diversify materials sourcing to nations with commerce agreements, generally known as “friendshoring”. Sadly, this tax credit score is slated for elimination within the invoice handed by the Home in Could, due to this fact creating extra market uncertainty for the battery and EV {industry}. The present proposal eliminates it for many EVs in 2026 and the credit score would go away fully by 2027. The Used Clear Car tax credit score (25E) is eradicated completely, lowering accessibility for decrease revenue households seeking to change to electrical.

As well as, long-term industry-wide automobile air pollution requirements play an important position, offering automakers with extra certainty and course for his or her R&D investments and enabling corporations to compete on a stage enjoying discipline. The EPA automobile requirements cut back international warming air pollution, soot, and smog forming air pollution. They incentivize producers to extend the supply of unpolluted automobiles that meet drivers wants. Whereas this has been confirmed to be an efficient strategy to cleansing our air, it’s now on the chopping block. As famous earlier, Congress has already moved to dam states from implementing requirements to deliver extra electrical automobiles to sellers’ tons whereas the Home has included provisions within the finances reconciliation invoice to undermine federal gasoline economic system and emission requirements.

These drastic coverage adjustments, together with continually altering tariff insurance policies, are already hurting battery manufacturing investments. We’re seeing stalled U.S. manufacturing investments, which, in the event that they proceed, might halt job manufacturing, hurt our competitiveness within the international market, compromise provide chain safety, and gradual decarbonization.

Nevertheless, the Home adjustments aren’t baked into regulation—but. The reconciliation invoice is presently being thought of within the Senate and a number of other Senators have expressed an curiosity in tweaking tax provisions within the Home invoice. Till each chambers approve the identical textual content there’s an opportunity cooler heads can prevail. President Trump desires the invoice on his desk by Independence Day. Will the way forward for EV manufacturing exit with a bang? Or will drivers keep freedom to decide on the clear automobile that most closely fits their wants? Your member of Congress wants to listen to from you as quickly as potential earlier than these adjustments are baked in.

The US wants the EV tax credit score to help our battery manufacturing investments

To proceed making a resilient and aggressive US-based battery and EV {industry}, we have to help a coverage atmosphere of certainty. There have been three steadying methods to constructing the US battery economic system – spend money on US manufacturing, amplify demand indicators, and create sturdy and diversified partnerships with producing nations. The current rollback of promised authorities funding and the present risk to the EV tax credit add to the atmosphere of uncertainty that can harm the US manufacturing base.

There’s no approach round it – slashing incentives to construct a US EV provide chain is a significant blow at a crucial second. The US battery manufacturing {industry} is in a development stage and depends on continued sturdy EV demand. The mixture of demand and supply-side insurance policies is the technique that gives the most effective probability of efficiently making a resilient and aggressive battery provide chain in order that the US automotive corporations lead within the international automobile market and American staff can construct the automobiles of the 21st century.

Let your Senator know that the EV tax credit aren’t solely necessary for cleansing our air, but additionally for the way forward for EV manufacturing right here in the USA.